About INTEL

The INTEL project included the following activities:

- the set-up of a Social Partner Specialist Group on Skills Intelligence.

- a survey on current and future labour and skills shortages in the European private security services industry, delivering evidence-based data that is assembled in a dedicated report.

- a project study on existing best practices and recommendations to national Sectoral Social Partners, aiming to help them in understanding, anticipating, preparing and managing labour and skills shortages in the private security services industry across the EU

- national workshops which aimed at discussion findings and recommendations made by the INTEL project at national level. They were organised by CoESS’ members, and likewise supporting partners of the project, in Croatia (CSA), Germany (BDSW) and Sweden (Säkerhetsföretagen) in autumn 2022.

- a multi-stakeholder conference to conclude the project in February 2023 and launch this website.

About labour and skills shortages in the European private security services industry

The European private security services industry is facing diverse drivers of change impacting workers and businesses, on both the demand and supply sides. These drivers of change have already been assessed in detail in the previous EU-funded Social Partner Project of the Confederation of European Security Services (CoESS) and UNI Europa, “Anticipating, Preparing, and Managing Employment Change in the Private Security Industry”.

Between 2010 and 2019, the private security industry grew significantly in terms of the number of workers, further diversification of services, and the upscaling of the technical and professional expertise provided. This is largely due to changes on the demand side:

- Similar to the majority of the business ecosystems, the private security services industry is encountering opportunities and challenges resulting from technological developments. Clients increasingly demand the integration of new, more complex technologies in the more traditional security services – such as solutions empowered by Artificial Intelligence and drones.

- Further, security services are confronted with demands for new missions – both from public and private clients. This ranges from the protection of public spaces and Critical Infrastructure to the management of the COVID-19 pandemic, and comes with an increasing responsibility for the efficient and uninterrupted functioning of society and economies.

- Data gathered for the INTEL project suggest that the COVID-19 pandemic has impacted, and in some aspects, accelerated these developments. However, its long-term impact needs to be monitored.

Survey results from the supply side

From the supply side, the current sector workforce has a set of characteristics that poses specific challenges. European societies face in general already substantial labour and skills shortages. In private security, most workers in the industry are furthermore already middle-aged, with an older workforce, particularly in Eastern Europe. Also, the majority of workers in the industry are male. Lack of gender diversity is therefore a challenge to be addressed.

Consequent to these developments, the private security industry has been experiencing over the past years both a general shortage of labour and a shortage of specific skills in its current workforce. This can be confirmed by the results of the survey that was run among national Sectoral Social Partners and companies as part of the INTEL project:

- Labour and skills shortages are recognised as a key priority by all the key stakeholders in the industry’s employer organisations (65%), trade unions (61%) and companies (71%).

- 76% of the companies report facing increasing difficulties in recruiting people with specific skills relevant to meeting market demand, in the past 1-5 years.

- Roughly 48% of the companies struggle to respond to market demand due to skills shortages.

- 60% of the private security companies surveyed by this study expected labour and skills shortages and mismatches to increase in the next five years.

- Critically, 68% of companies expect that labour and skills shortages and mismatches will present a serious issue for the future development of their companies in the next five years.

- Almost 70% of the sectoral trade unions and employer organisations consider future skills shortages significant and likely to persist, causing a substantial negative business impact.

Survey results from the sectoral employer organisations and trade unions

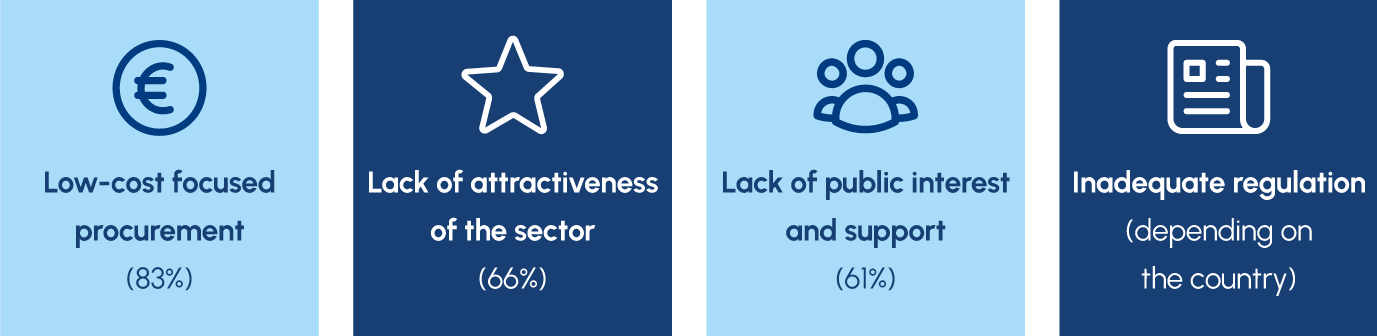

Responses of the sectoral employer organisations and trade unions to the survey highlight also important barriers to addressing labour and skills shortages in the private security services:

These barriers prompt recommendations for national Sectoral Social Partners in the private security services to find solutions to the challenge of labour and skills shortages – recommendations which are based on existing best practices and which are assembled in the INTEL project’s final study.

The data on current and future labour and skills shortages in the private security services industry is extensively presented in a respective report delivered by the INTEL project.